3 GRAPHS THAT PROVE THERE WON’T BE A HOUSING MARKET CRASH

There are a whole lot of people who think a housing crash is coming.

And who can blame them? From YouTube videos to social posts and media headlines…there’s so much noise about what’s ahead for the housing market.

Whether you realize it or not, this is negatively impacting your business, because this misconception is affecting your clients’ thoughts about the market, and ultimately, their decisions.

HOW HOUSING CRASH FEARS IMPACT BUYERS AND SELLERS

On the one hand, you have people sitting on the sidelines waiting (and hoping for) home prices to drop. They want a crash to happen because they’re holding out for that deal of a lifetime. In fact, a survey found that 32% of people think it’s the only way they’ll be able to buy a home.

Then you have current homeowners. Maybe they’re thinking about selling, but worry they’ll take a loss if prices drop drastically. They don’t want to buy their next home at the top of the market to then have their investment go belly up.

If you’ve gotten this objection from even just one client or prospect, you have a chance to clear the air and prove your value as a housing market expert.

THE MAIN REASON THE HOUSING MARKET WON’T CRASH

Let’s go back to your high school economics class. You’ll remember one of the first lessons it covered: supply and demand.

When supply is low and demand is high, prices go up. When it’s the reverse, they go down.

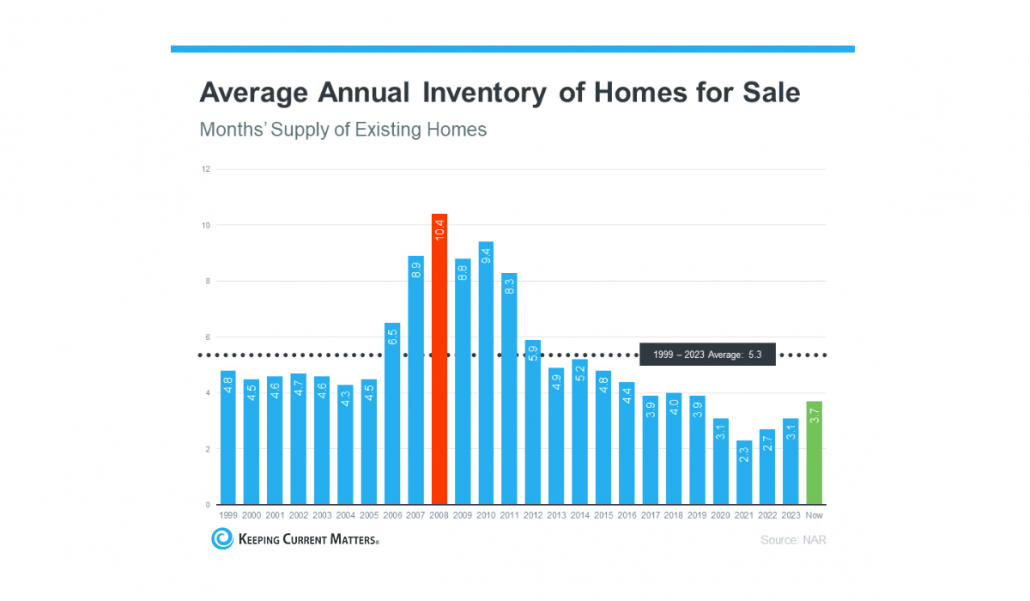

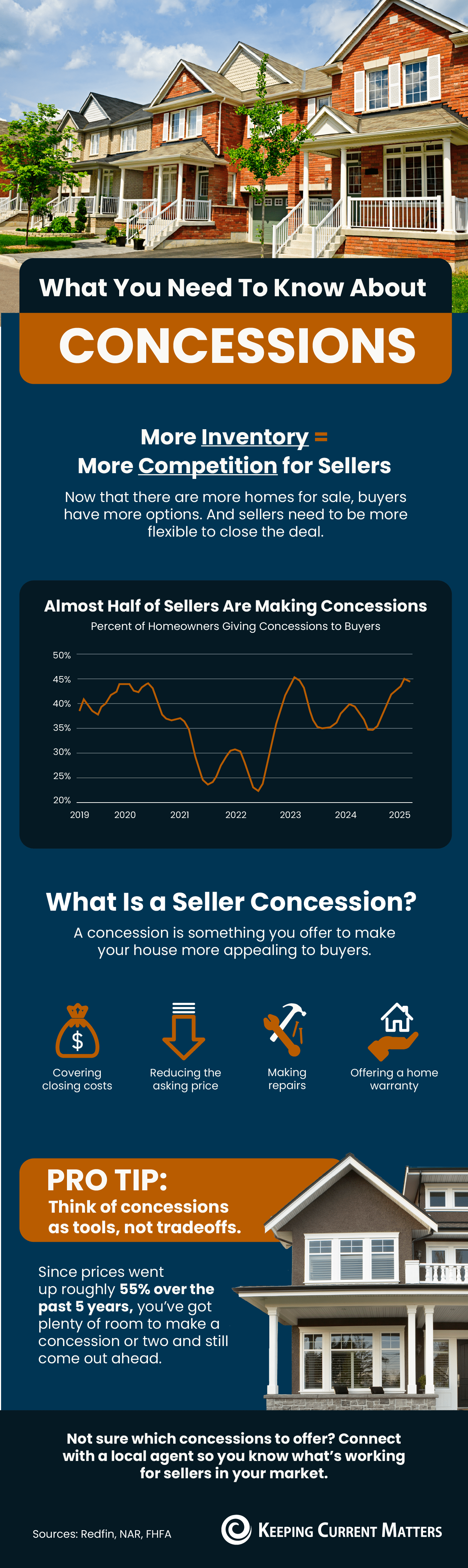

Looking at it from the lens of the housing market, we can apply the same rule. While inventory is on the rise, there are still too few homes for sale to meet demand.

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101,” said Mark Fleming, Chief Economist at First American.

Therefore, inventory, or rather a lack thereof, is the biggest reason we will not see a drastic drop in home prices.

But if that isn’t enough to convince your clients that a housing crash isn’t coming, showing them these three graphs should help too.

WHY TODAY’S MARKET IS SO DIFFERENT FROM 2008

Even though there are more homes for sale now compared to last year, the overall supply is still pretty low. Nationally, we have about a third of the inventory we had in 2008. With fewer homes on the market, prices are unlikely to drop significantly.

A repeat of 2008 would require a lot more people selling their homes and not enough buyers, and that’s just not happening, especially since so many people are holding on to their homes right now due to their historically low mortgage rates.

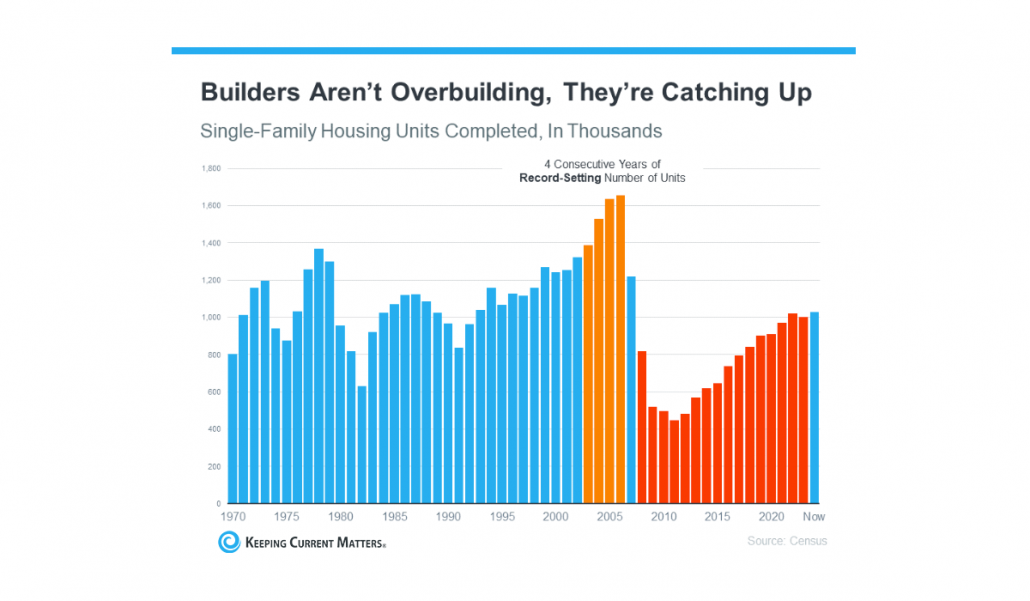

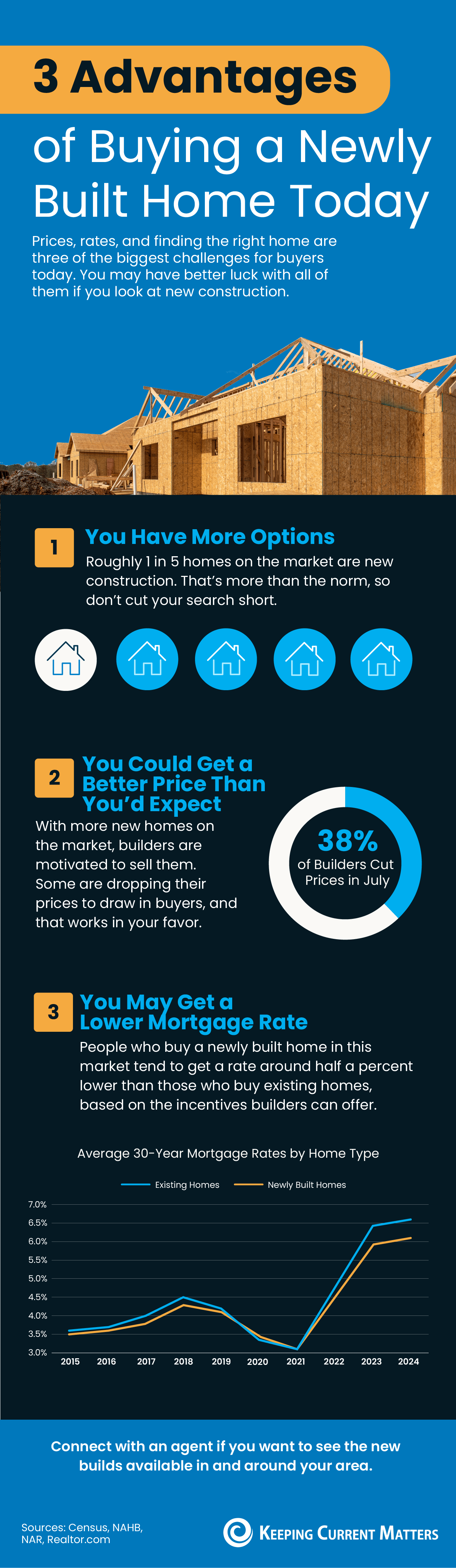

There’s also been talk about all the new homes being built. While new houses make up a bigger slice of the market than usual, it’s nothing to worry about.

Builders aren’t overbuilding right now – they are just catching up from years of underbuilding since the last crash. So, even with more new homes available, the supply still isn’t meeting the demand.

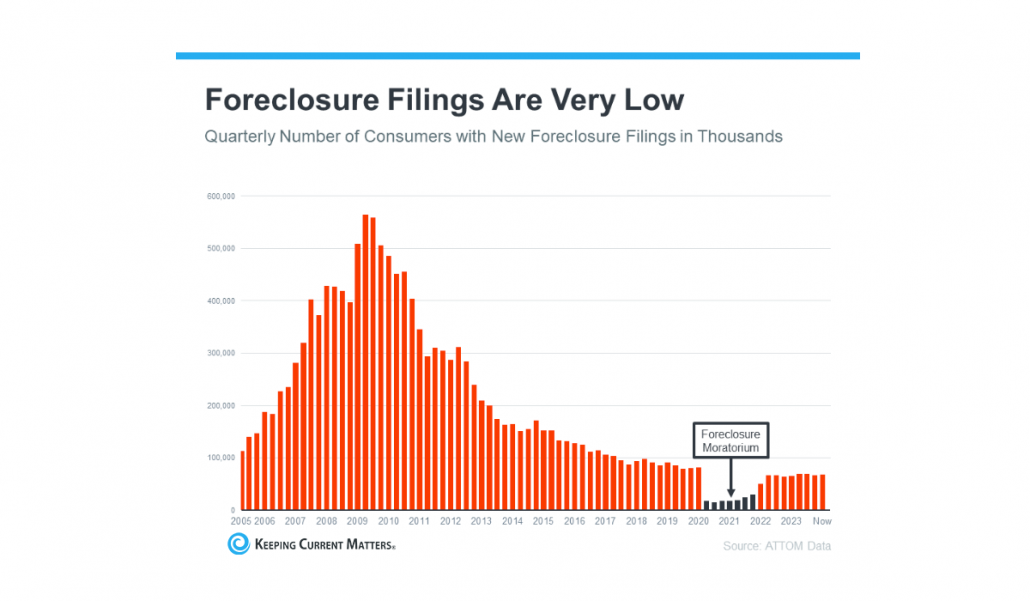

Foreclosures and short sales aren’t flooding the market either. Thanks to tighter lending standards, we have more qualified buyers and fewer foreclosures. Even though foreclosures are up a bit, as expected, they’re still below normal levels.

This means we’re not seeing even close to the number of distressed properties that we did during the last crash.

And like the cherry on top of a sundae, we have this quote from Business Insider to drive this point home:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

So, with inventory levels low compared to demand, prices aren’t going to drop drastically. Even top industry economists and experts agree: this isn’t a bubble about to burst. We’re in a much more stable place than in 2008, and a market crash is unlikely.

Everyone in your sphere needs to hear this. They need to see the data and hear what trusted professionals are saying, not some person on YouTube. That’s how you help them connect the dots and bust any fears or doubts.

And it’s why these three graphs are so powerful – they show just how different today’s market is from the one that led to the crash.

Being proactively educated instead of reactive is and always will be the best road to take if you want to be a true real estate expert.

That’s how you build trust, prove your value, and grow your business.

Categories

- All Blogs (192)

- Affordability (3)

- Agent Value (4)

- Buying & Selling (101)

- Buying Tips (18)

- First Time Home Buyers (22)

- For Sale By Owner (1)

- Forecast (1)

- Home Buyers (132)

- Home Owner (7)

- Home Owners (7)

- Home Prices (6)

- Housing Market (104)

- Inventory (1)

- Mortgage Rates (37)

- New Construction (4)

- Real Estate (151)

- Real Estate Investing (4)

- Selling Tips (13)

- Selling Your Home (74)

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "