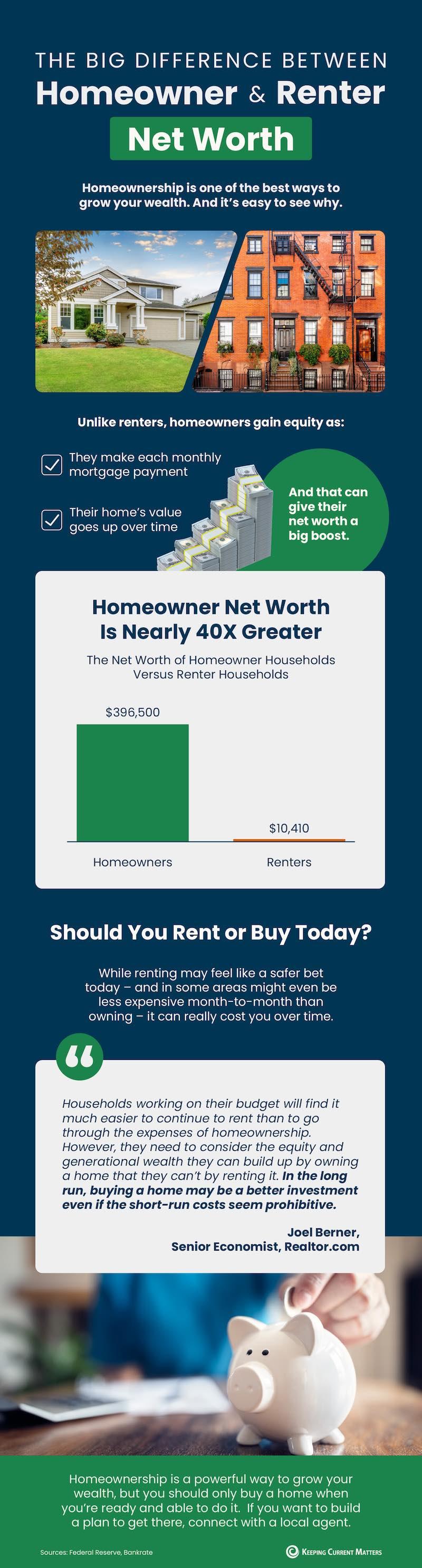

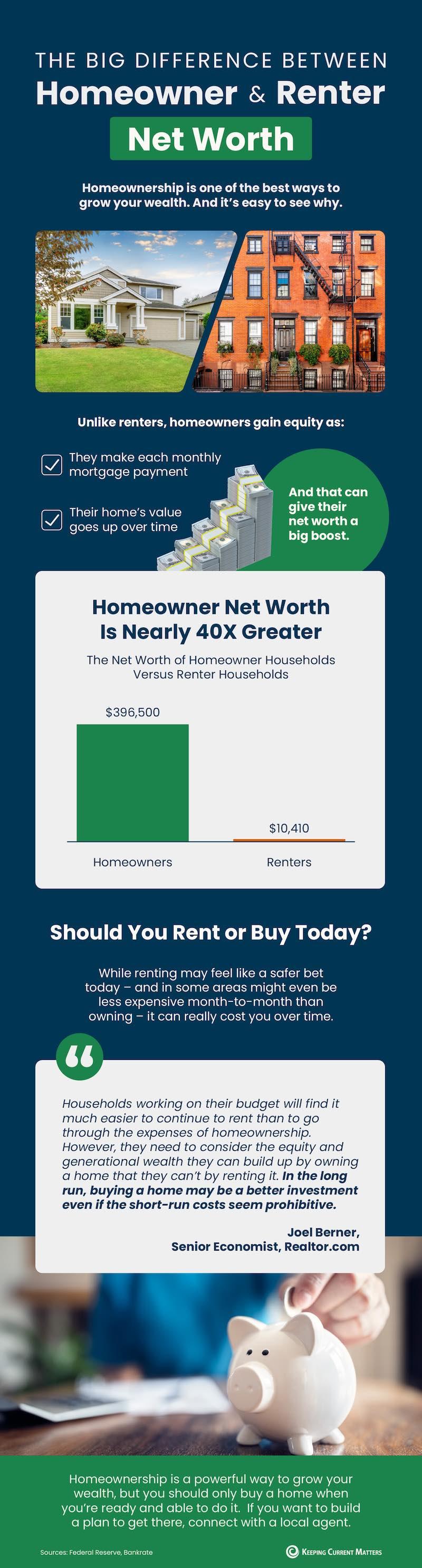

The Big Difference Between a Homeowner’s and a Renter’s Net Worth

Some Highlights

- Homeownership is one of the best ways to build wealth in our country and it’s easy to see why.

- As you pay down your mortgage and as home values rise over time, you gain equity – and that helps grow your net worth. That’s why a homeowner’s net worth is nearly 40X greater than a renters.

- But you should only buy a home when you’re ready and able to do it. If you want to build a plan to get there, connect with us.

Categories

- All Blogs (226)

- Affordability (11)

- Agent Value (6)

- Buying & Selling (111)

- Buying Tips (36)

- Downsize (2)

- Economy (1)

- Equity (2)

- First Time Home Buyers (43)

- For Buyers (4)

- For Sale By Owner (3)

- for sellers (2)

- Forecast (3)

- Home Buyers (148)

- Home Owner (20)

- Home Owners (20)

- Home Prices (13)

- Housing Market (107)

- Inventory (8)

- Mortgage Rates (45)

- Move-Up (1)

- New Construction (9)

- Real Estate (153)

- Real Estate Investing (4)

- Selling Tips (24)

- Selling Your Home (89)

Recent Posts

This May Be the Best Time To Buy a Brand-New Home

Why More Homeowners Are Giving Up Their Low Mortgage Rate

The 3 Housing Market Questions Coming Up at Every Gathering This Season

How To Find the Best Deal Possible on a Home Right Now

The Top 2 Things Homeowners Need To Know Before Selling

4 Reasons Your House Is High on Every Buyer’s Wish List This Season

Why So Many People Are Thankful They Bought a Home This Year

Most Experts Are Not Worried About a Recession

Would You Let $80 a Month Hold You Back from Buying a Home?

Are Builders Overbuilding Again? Let’s Look at the Facts.

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "