What You Need To Know About Pre-Approval

Some Highlights

- Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

- Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

- Connect with us and our trusted lender, Jennifer Salazar, to get the process started.

Categories

- All Blogs (192)

- Affordability (3)

- Agent Value (4)

- Buying & Selling (101)

- Buying Tips (18)

- First Time Home Buyers (22)

- For Sale By Owner (1)

- Forecast (1)

- Home Buyers (132)

- Home Owner (7)

- Home Owners (7)

- Home Prices (6)

- Housing Market (104)

- Inventory (1)

- Mortgage Rates (37)

- New Construction (4)

- Real Estate (151)

- Real Estate Investing (4)

- Selling Tips (13)

- Selling Your Home (74)

Recent Posts

History Shows the Housing Market Always Recovers

Should You Still Expect a Bidding War?

From Frenzy to Breathing Room: Buyers Finally Have Time Again

Is It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff

Are These Myths About Buying a Newly Built Home Holding You Back?

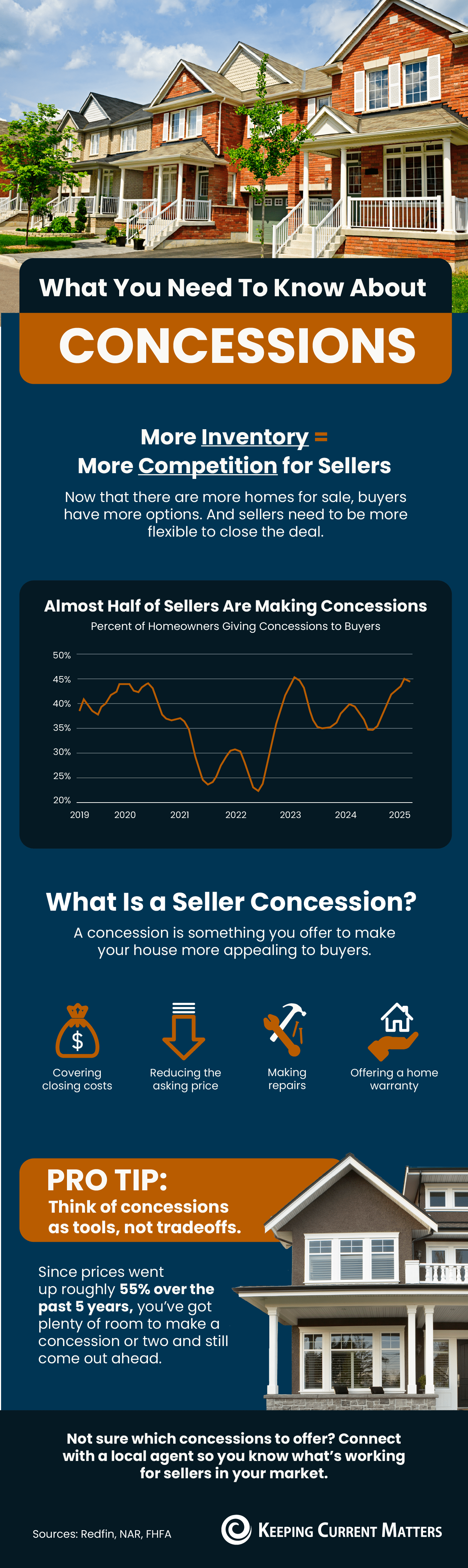

What You Need To Know About Concessions

A Second Home Might Be the Missing Piece in Your Retirement Plan

Why Selling Without an Agent Can Cost You More Than You Think

The Truth About Down Payments (It’s Not What You Think)

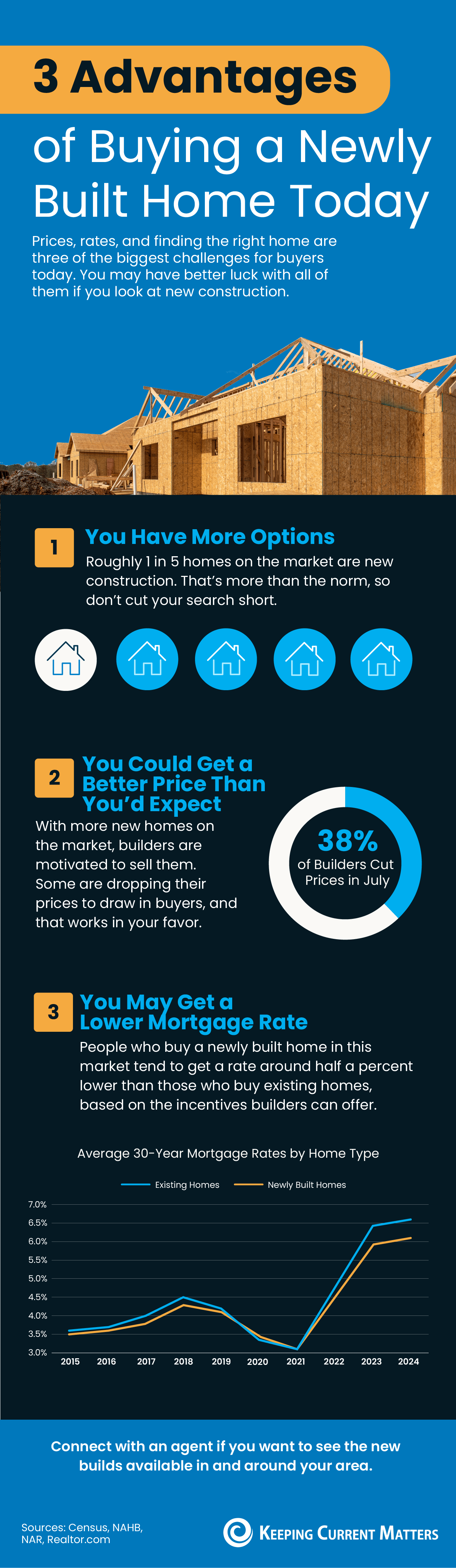

3 Advantages of Buying a Newly Built Home Today

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "