Breaking Into the Market: Smart Moves for First-Time Buyers

If you’re like a lot of aspiring homebuyers, there’s a major hurdle standing in your way — the cost of living. From groceries to gas, eggs, and just about everything else, prices have gone up. And that rings true for home prices, too. But even when everything feels expensive, there are still ways

Read More

The Secret To Selling This Spring: Start the Prep Work Now

Spring is the busiest season in the housing market. It’s the time of year when buyers are most active – that means it’s when homes sell faster and for top dollar. If you’ve already got a move on your mind, why not list this spring and take advantage of the added buyer demand? Since spring is just

Read More

The Perks of Buying a Fixer-Upper

There’s no denying affordability is tough right now. But that doesn’t mean you have to put your plans to buy a home on the back burner. If you’re willing to roll up your sleeves (or hire someone who will), buying a house that needs some work could open the door to homeownership. Here’s everything

Read More

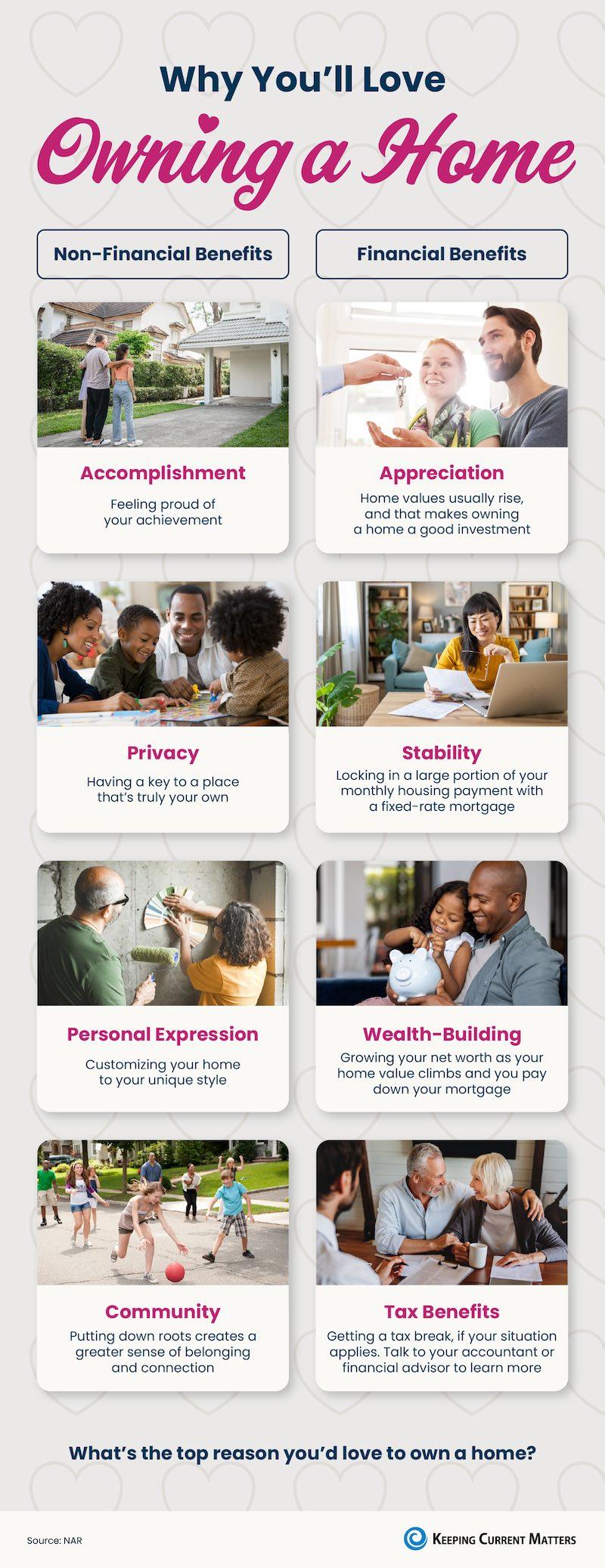

Why You’ll Love Owning a Home

Read More

Categories

Recent Posts