What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you. Covers Repairs and Rebuilding Costs

Read More

Buying Your First Home? It’s Okay To Feel Nervous

Buying your first home is exciting, but let’s be real – it can also feel overwhelming. It’s a big step, and with that comes plenty of questions. Am I making the right decision? Can I really afford this right now? Will I be able to make ends meet if I have unexpected repairs? What if I lose my job

Read More

Is the Housing Market Starting To Balance Out?

For years, sellers have had the upper hand in the housing market. With so few homes for sale and so many people who wanted to purchase them, buyers faced tough competition just to get an offer accepted. But now, inventory is rising, and things are starting to shift in many areas. So, is the marke

Read More

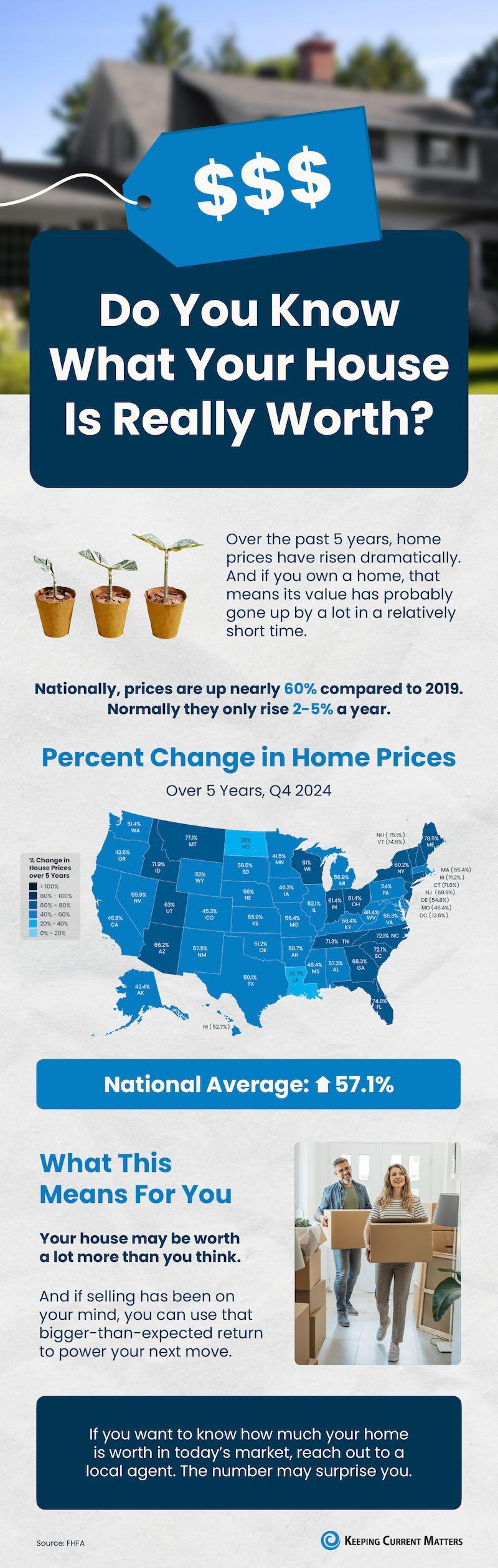

Do You Know What Your House Is Really Worth?

Some Highlights Over the past 5 years, home prices have risen dramatically. If you own a home, that means your house may be worth a lot more than you think. Nationally, prices are up nearly 60% since 2019. And, if selling has been on your mind, you can use that bigger-than-expected return to p

Read More

Categories

Recent Posts