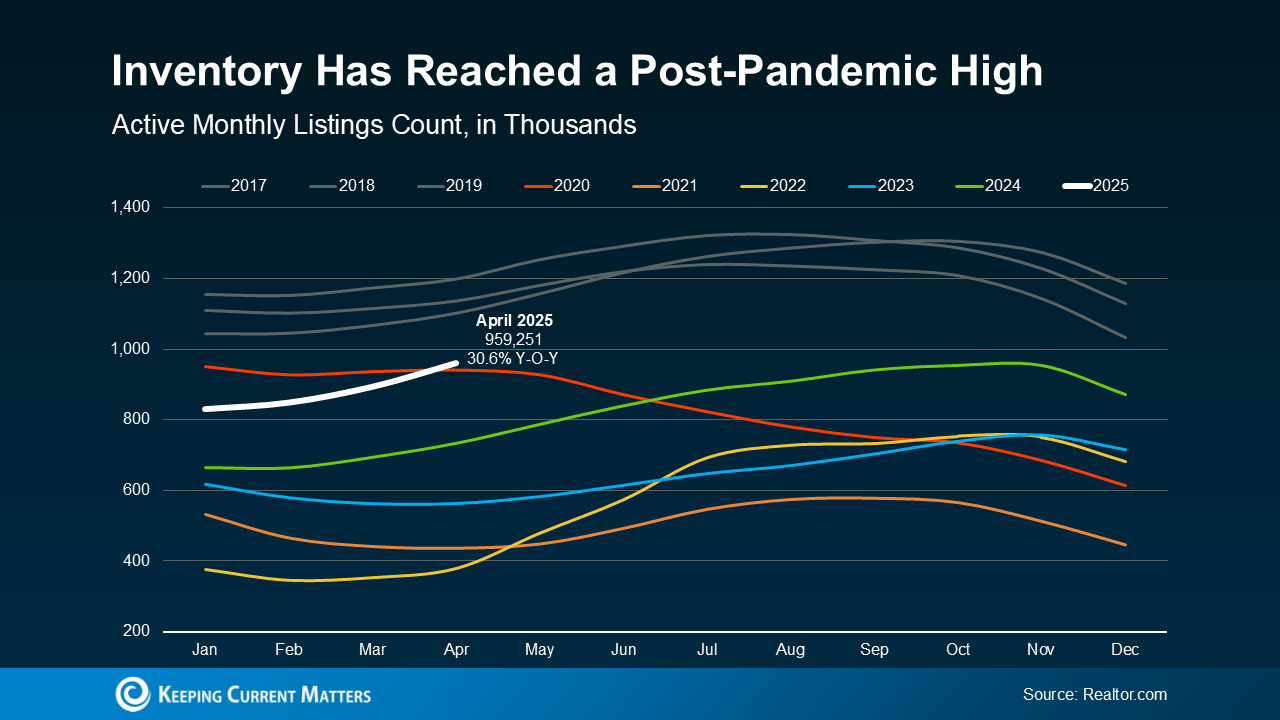

More Homes for Sale Isn’t a Warning Sign – It's Your Buying Opportunity

Maybe you’ve heard the number of homes for sale has reached a recent high. And it might make you question if this is the start of another housing market crash. But the reality is, the data proves that’s just not the case. In most areas, more inventory isn’t bad news. It’s actually a sign of the mar

Read More

Housing Market Forecasts for the Second Half of the Year

From rising home prices to mortgage rate swings, the housing market has left a lot of people wondering what’s next – and whether now is really the right time to move. There is one place you can turn to for answers you want the most. And that’s the experts. Leading housing experts are starting to

Read More

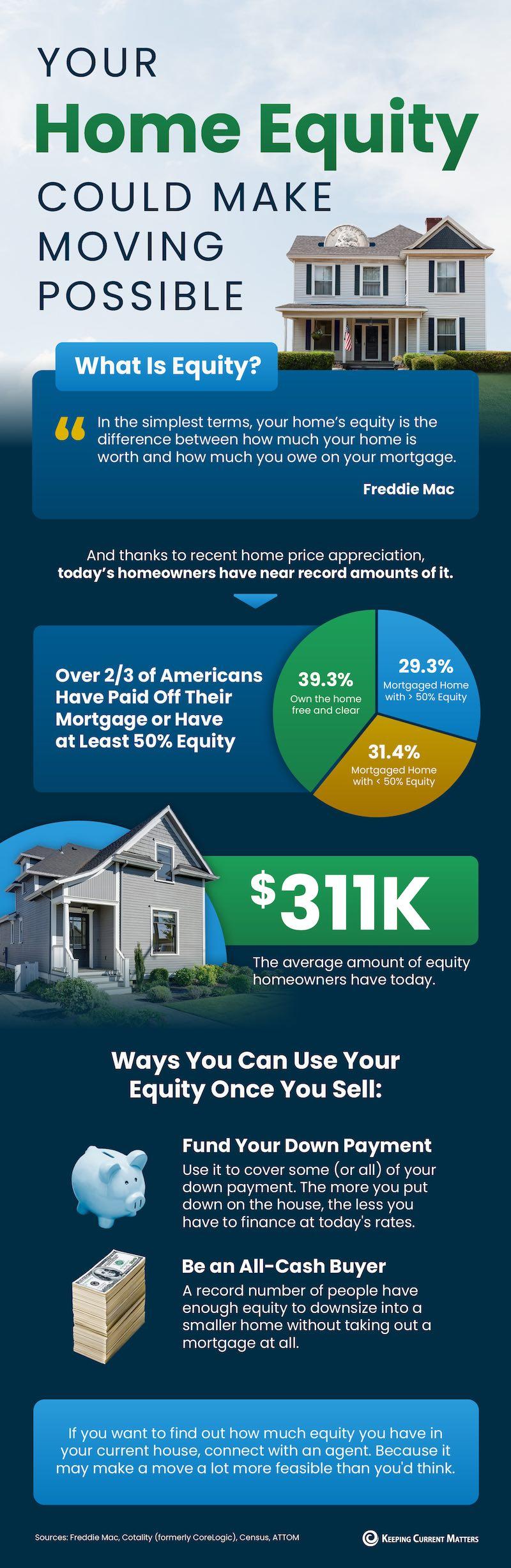

Your Home Equity Could Make Moving Possible

Some Highlights Thanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity. Once you sell, you can use it to fund your down payment on your next home or maybe even to buy a smaller house in cash. If

Read More

What an Economic Slowdown Could Mean for the Housing Market

Talk about the economy is all over the news, and the odds of a recession are rising this year. That’s leaving a lot of people wondering what it means for the value of their home – and their buying power. Let’s take a look at some historical data to show what’s happened in the housing market durin

Read More

Categories

- All Blogs (212)

- Affordability (9)

- Agent Value (6)

- Buying & Selling (108)

- Buying Tips (28)

- Downsize (1)

- Equity (1)

- First Time Home Buyers (36)

- For Sale By Owner (2)

- Forecast (3)

- Home Buyers (143)

- Home Owner (16)

- Home Owners (16)

- Home Prices (11)

- Housing Market (107)

- Inventory (4)

- Mortgage Rates (44)

- New Construction (7)

- Real Estate (153)

- Real Estate Investing (4)

- Selling Tips (20)

- Selling Your Home (85)

Recent Posts